The mobile app programmatic ecosystem is slowly but surely transitioning from second price to first price auctions. Some exchanges like AdColony, Google AdX, Samsung and other major players in the industry are already using first price auctions while some others like MoPub have started to gradually move to first price auctions from Q2 2020.

Many mobile app programmatic traders are used to set up bidding strategies assuming a second price auction mechanism. However, as the move to first price auction gains more traction in the mobile app space, this will result in changes in bidding strategies. While there has been a lot of discussion around how first price auctions help publishers, I wanted to spend some time talking about this phenomenon from a buyer’s perspective.

First Things First- How Will the Move to First Price Change the Auction Mechanics?

Before we delve into details, let’s do a quick recap of the difference between first and second price auctions

Second Price Auction– An auction mechanism where the highest bidder wins and the winning bidder pays a unit more (say $0.01) than the second highest bidder. Hence, the bidder can bid the maximum amount that it’s willing to pay for a commodity, but ends up eventually paying a final value which is lower than its bid value. The final value that it pays is determined by the competitive prices.

First price auction– An auction mechanism where the highest bidder wins and the winning bidder pays exactly what it bid. Hence, in reality, the bidder tries to bid somewhere between X and Y where X is what the competition might bid for the commodity and Y is the maximum value that the bidder is willing to pay for the commodity. If Y >> X, then the bidder ends up overpaying for the commodity.

First price auction– An auction mechanism where the highest bidder wins and the winning bidder pays exactly what it bid. Hence, in reality, the bidder tries to bid somewhere between X and Y where X is what the competition might bid for the commodity and Y is the maximum value that the bidder is willing to pay for the commodity. If Y >> X, then the bidder ends up overpaying for the commodity.  For those who want to delve deep into auction mechanics and understand different types of auctions, I found some of these links useful: A Survey of Auction Types, Auction Theory, Game Theory- Auctions. With this basic understanding, let’s see how these auction mechanics work in an RTB (Real-time bidding) environment. Let’s assume that for a single digital ad opportunity, there are 4 bidders (DSP’s) who are trying to win the RTB auction happening simultaneously across 2 exchanges/SSP’s.

For those who want to delve deep into auction mechanics and understand different types of auctions, I found some of these links useful: A Survey of Auction Types, Auction Theory, Game Theory- Auctions. With this basic understanding, let’s see how these auction mechanics work in an RTB (Real-time bidding) environment. Let’s assume that for a single digital ad opportunity, there are 4 bidders (DSP’s) who are trying to win the RTB auction happening simultaneously across 2 exchanges/SSP’s.

Second Price Auction

In the above representation, assume exchange1 and exchange2 are running a second price auction. DSP1 won Exchange1 auction with a win price of $1.01 (one cent above competition price of $1) and DSP4 won Exchange2 auction with a win price of $2.01 (one cent above competition price of $2). Now when these two winners ( DSP1 and DSP4 ) participate in the final auction that happens in the publisher ad server, DSP4 wins with a win price of $2.01 even though DSP1 made the highest original bid of $6.

In the above representation, assume exchange1 and exchange2 are running a second price auction. DSP1 won Exchange1 auction with a win price of $1.01 (one cent above competition price of $1) and DSP4 won Exchange2 auction with a win price of $2.01 (one cent above competition price of $2). Now when these two winners ( DSP1 and DSP4 ) participate in the final auction that happens in the publisher ad server, DSP4 wins with a win price of $2.01 even though DSP1 made the highest original bid of $6.

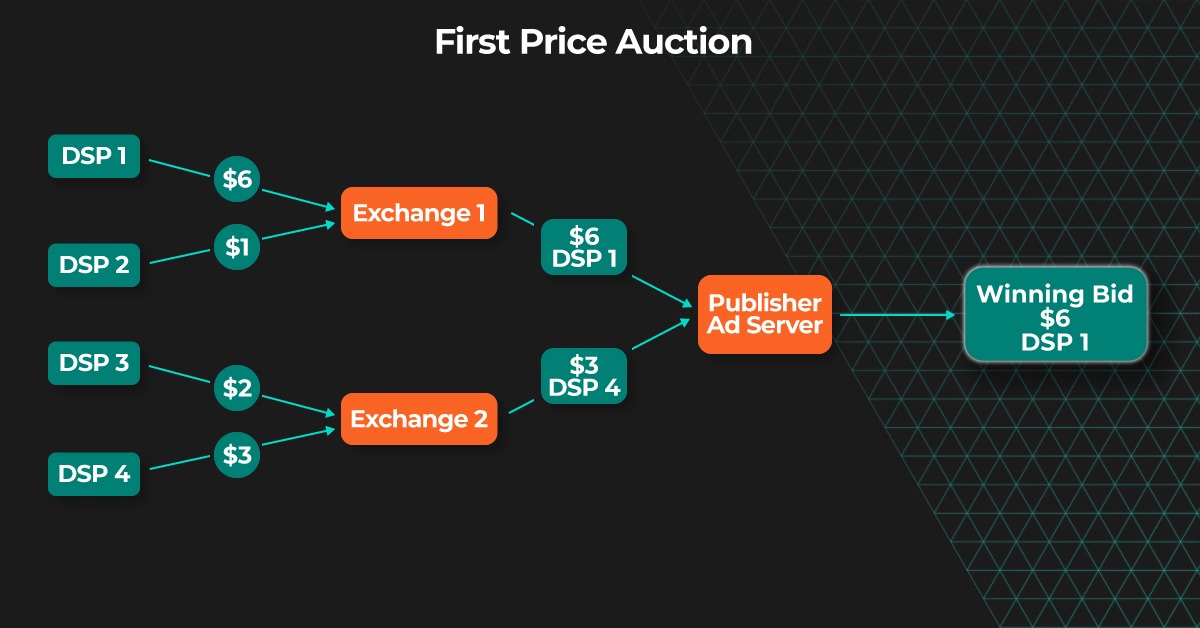

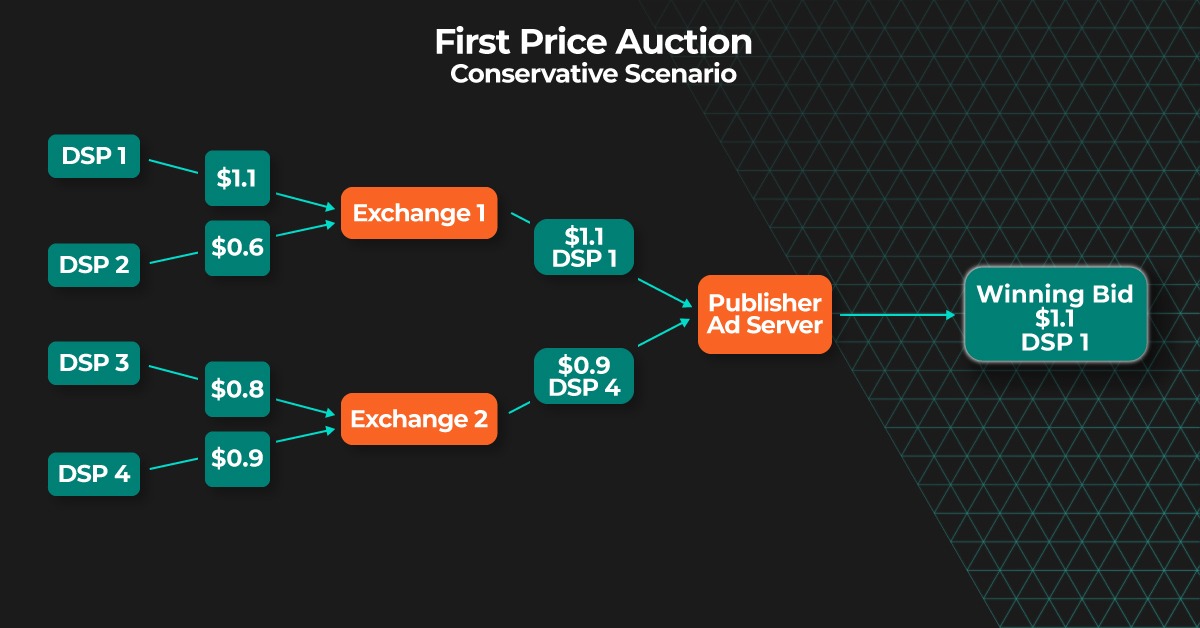

First Price Auction

Let’s run the same simulation assuming all parties involved are running a first party auction. In this case, since you pay what you bid, DSP1 ends up winning the auction which is a win-win situation for both the publisher as well as the advertiser and the DSP (For simplicity, I have ignored exchange’s take rates in the above simulation).

The first price auction also helps in eliminating some of the auction gaming that can happen today. For instance, in the above example of a second price auction, Exchange 1 can artificially inflate the clearing price for DSP1 to be anything between $1 and $6 and increase it’s take rate accordingly. In this case, it will be extremely difficult for DSP1 to figure out the true value of the inventory since it can’t be sure if the higher clearing price was because of competition or because of auction gaming.

First Price Auction is Great for Publishers but What’s in it for Advertisers?

We have heard many advertisers asking us the above question- First price auction will make the inventory more expensive so it’s great for publishers, but as a buyer, what’s in it for me?

Yes, first price auctions clearly help publishers get the true price of the inventory but many buyers fear that this will make the inventory expensive and they will end up paying more for the same impression. Although this might be partially true (we’ll talk about this later), however, even if the inventory becomes a bit more expensive, it has advantages for the buy side of the ecosystem and the biggest of them being access to Users.

If you are running a programmatic campaign and you really want to reach a certain cluster of users who satisfy some key criteria (audience whitelist, model driven insights, retargeting lists, etc), first price auction gives you a level playing field and a higher chance to reach that user that you really wanted. While you might pay more to reach the user, however, if you are able to meet and exceed the eventual KPI (CPI, CPA, RoAS, etc), this is a better deal for you as a buyer than losing out an opportunity to show an ad to that user that really mattered. Along with header bidding, the move to first price auction is giving an equal opportunity to advertisers who use a bidder, to reach highly valued inventory and user cohorts and not get left out because someone else cracked a “first look” deal.

Good for Publishers and Good for Buyers- So Everything’s Going to be Great in the First Price Auction World?

First price auction definitely has its advantages. But it will be premature to say that everyone will always benefit from this. From a publisher’s perspective, while the expected outcome is an increase in CPM, it’s not necessary that this will always happen. Let’s consider the following example. I call it the “First Price Auction Conservative Scenario”:

Let’s compare this scenario with the first price auction example shared earlier: the winning bid CPM will increase from $.2.01(second price scenario) to $ 6 (first price scenario) only if DSP1 does not change its bidding strategy as it moves from second to first price auctions. However, in reality, if the DSP knows that this is a first price auction, this might change the bidding behavior of the DSP/programmatic trader and hence all the participants might start bidding conservatively. In classic auction theory, this concept is known as Winner’s curse because if you are winning this auction, this means your bid was more than the competition and hence you ended up overpaying for something which the market valued at a lower amount. This concept can eventually cause the bidding party to place a bid which is lower than their estimated value of the bid. For instance, in the above example, the win price decreases from $2.01 in the second price auction to $1.1 in the first price auction because the DSP’s started bidding conservatively.

While this is an extreme example, the point I want to make is that eventually, the market will find a new equilibrium as different players try to find the new normal for them. While I do believe that the avg CPM for publishers will increase, it will be incorrect to assume the increase will be as high as the difference between DSP’s current bid and win price that exists in the second price world today.

So as a Buyer, What Should I Ask My DSP?

As a smart buyer, you should ask your buying platform what they are doing to handle the transition to first price auctions. However, what action you can do based on these answers depends on whether you are working with a managed DSP or working with a platform where you have more transparency and control of your campaigns. Either way, some questions that you should ask are

- First price bidding strategy– What’s the product strategy to handle the transition to first price auctions? Insist to talk directly with the product managers and go in detail and ask deeper questions to understand how this impacts you

- Bid shading algorithms– Does the DSP employ some bid shading algorithms to manage the bid prices. If yes, don’t take “we have a model” as an answer. You have all the right to understand how this model works

- Bid vs Win price differences– Ask your DSP what’s the current spread of bid vs win price for your campaigns. If your DSP does not provide you full transparency into this data, keep insisting, because this data can be really insightful for you. Industry changes are usually a good opportunity to understand more about the ecosystem. Don’t let this opportunity go.

How’s Kayzen Handling This

Below i’ll summarize steps Kayzen has taken to ensure the move to first price auction is seamless for our advertisers

- Max CPM Limit– Advertisers can enable a max CPM limit in their campaigns which ensures it will never bid more than the specified CPM, thereby protecting you from bidding very high CPM values when using CPC/CPI optimization models. This works best when you want to use ML models to predict bid price but still want to limit the max CPM that you will like to pay for an impression. Because we share raw log level data with our advertisers, they usually have a good understanding of the CPM ranges they want to bid. More information about this feature can be found here.

- Bid Optimization– The bid optimization (bid shading )algorithm aims to optimize the eCPM by looking at various parameters like os, publisher app, country, etc and changes the bid CPM accordingly to achieve a specific win rate. For campaigns that are bidding using CPM/CPC optimization models, we highly recommend enabling Bid Optimization ON. Moreover, all our customers get access to this feature and there are no extra costs or markups involved for using this feature.

- Supply Side Settings– Some exchanges like Rubicon, BidSwitch, etc provide their own bid shading algorithms for DSP’s. We work closely with our exchange partners to test, evaluate and enable these models for bids taking place via Kayzen.

- Bid Price Simulations– Since we pride ourselves on giving full transparency to our customers, we run simulations and share data with our customers which tries to predict what could have happened if they had applied different bidding strategies. For instance, if the bid price for portrait video was capped at $40 CPM and for 320*50 banner at $4 CPM, how would that have changed the impression, click, install, RoAS distribution? With this granular level of data access, the customer’s BI teams are able to run even deeper analysis specific to their use cases and are able to further strategize their bidding strategies.

In summary, while there has been enough discussion in the market around the move to first price auctions and adoption of header bidding, the devil is always in the details. What worked for desktop DSP’s during the first wave of moving to first price auction may or may not work in this second wave happening in the mobile app ecosystem. Talk to your buying platforms and understand how this impacts your programmatic strategy.